utility for service tax return

304 842-8200 or 304 842-8230 z. Public Utility Service Tax Excise Tax Return Form City of Bridgeport z Finance Department P.

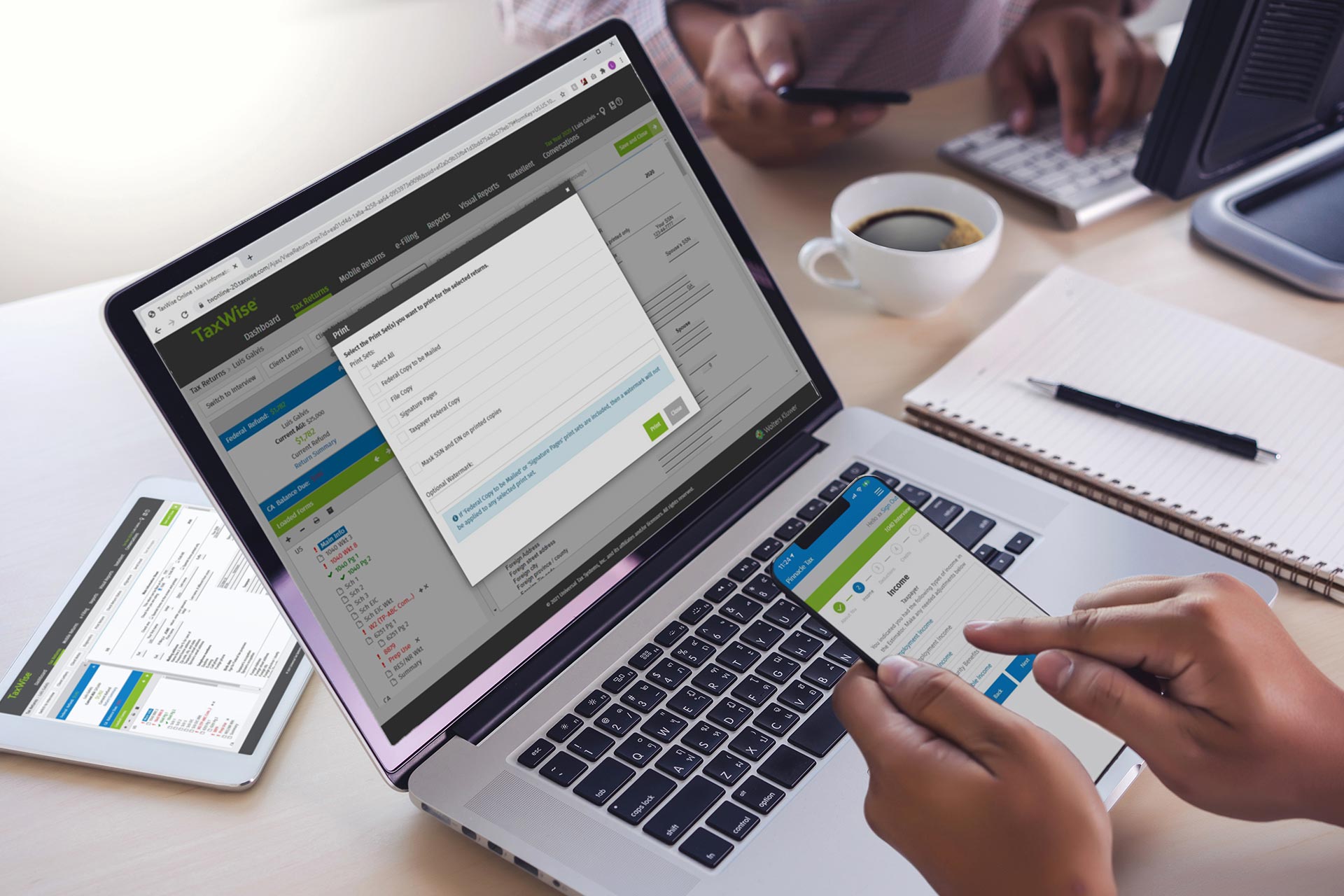

Taxwise Tax Preparation Software Wolters Kluwer

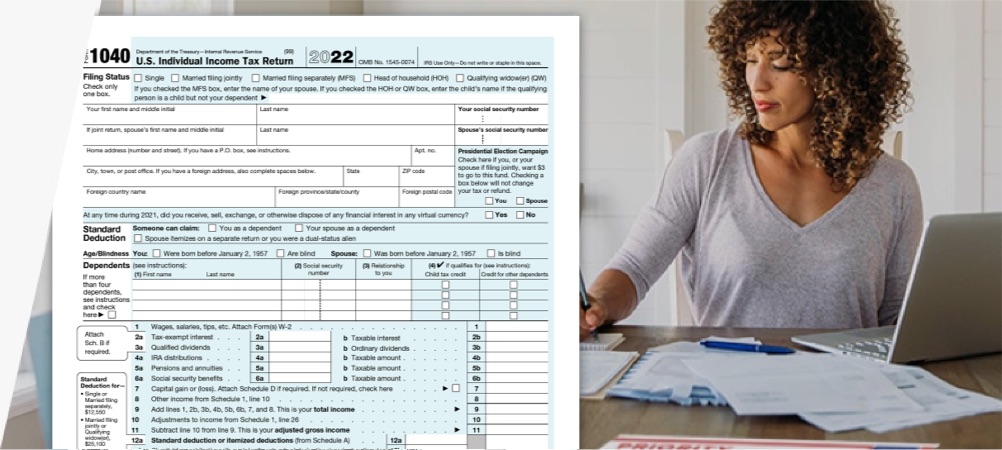

For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000.

. Documents on this page are provided in pdf format. Omnibus operators subject to nys department of public service supervision. Box 1310 z z Bridgeport WV 26330 Phone.

Municipal public service tax MPST is locally imposed and administered by municipalities and charter counties under Chapter 166 Florida Statutes. Section 179 deduction dollar limits. Utility services use tax due for the period multiply line 4 by the tax rate of 14 percent 0014.

Public utility service tax excise tax return form city of bridgeport z finance department p. Click the Returns tab. The basic utility tax rate is 235 of gross income or gross operating income.

However different rates apply to bus companies and railroads as shown below. NYC-95UTX - Claim for REAP Credit Applied to the Utility Tax. This limit is reduced by the amount by which the cost of.

Make sure all preprinted information is correct for the tax period you are filing. Utility service providers must file a return and remit the full amount of tax collected to the City. Service Tax Appeal before Commissioner Appeals.

The following paragraphs outline the filing cycle based upon the amount. NYC-98UTX - Claim for. You must file a monthly return even if no tax is owed.

Download ST3 Return Excel. Telegraph companies distribution of natural gas and collection of sewerage. The utility service use tax is an excise tax levied on the storage use or other consumption of electricity domestic water natural gas telegraph and telephone services in the State of.

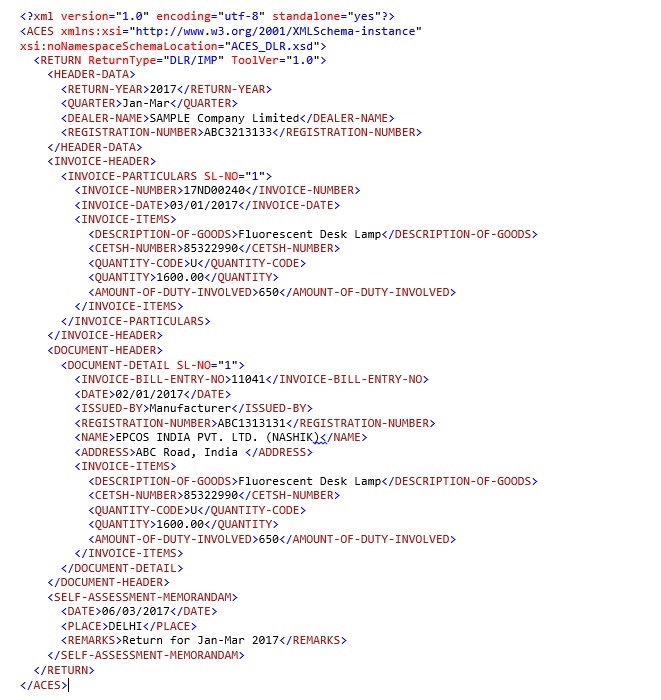

Assessees can file their Central Excise and Service Tax Returns using following offline Excel UtilitiesXML Schema by downloading the same from this page. Return of Service Tax Excel Utility Form ST-3. The Service Tax return is required to be filed by any person liable to pay the Service Tax.

The person liable to pay Service Tax should himself assess the Tax due on the Services provided. Click the View or Amend Return link next to the return you want to view or print a copy of. The service tax return is required to be filed by any person liable to pay the.

Urban transportation and watercraft vessels under 65 feet in length. Please sign and date each return. Central.

Current Utility Tax Forms 2021 Utility Tax Forms. The sole responsibility of the Florida. Memorandum for Provisional Deposit of Service Tax.

In the Excise Tax Account panel click the View Periods and Amend Returns link.

Federal Tax Returns 30 Investment Tax Credit Itc Native Solar

Can Rent And Utilities Be Used As A Tax Deduction

What Happens If The Same Income Tax Return Is E Filed Twice

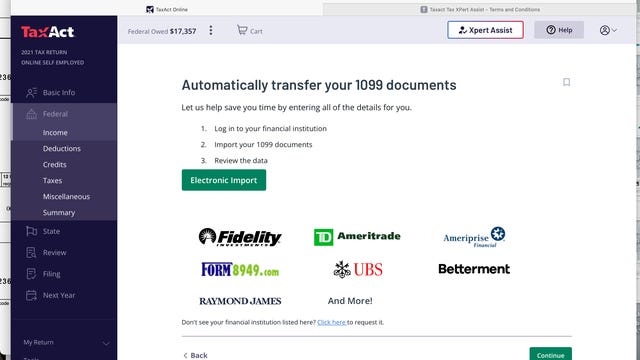

Filing Taxes In 2022 Irs Deadline Tax Credits Unemployment And Tips

Software For Complex Tax Returns Intuit Lacerte

Utility Customer Service City Of Carrollton Tx

E Return Filing Of Central Excise And Service Tax Returns Make Easy With Xml Utility In Sage 300 Erp Sage 300 Erp Tips Tricks And Components

Turbotax Home Business Cd Download 2021 2022 Tax Software For Personal Small Business Taxes

Residential Service Forms Sun Prairie Utilities

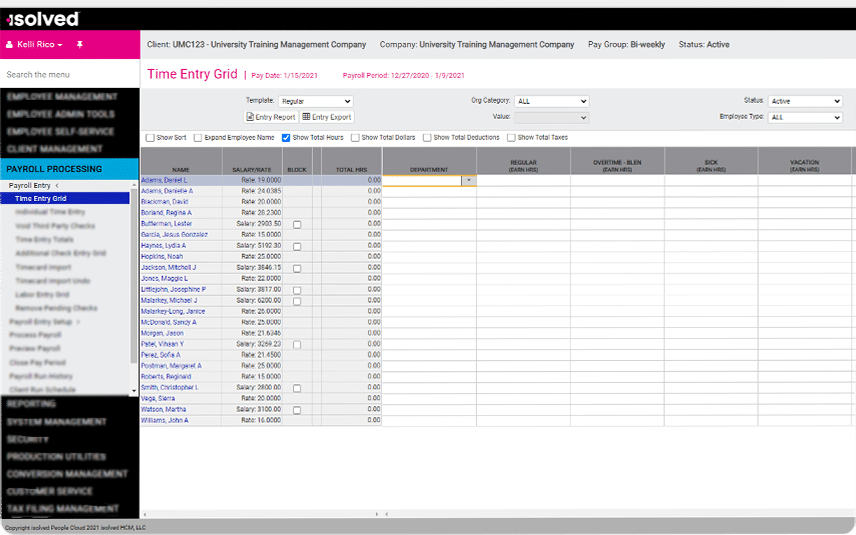

Complete Payroll Solution Hr Payroll Processing Software

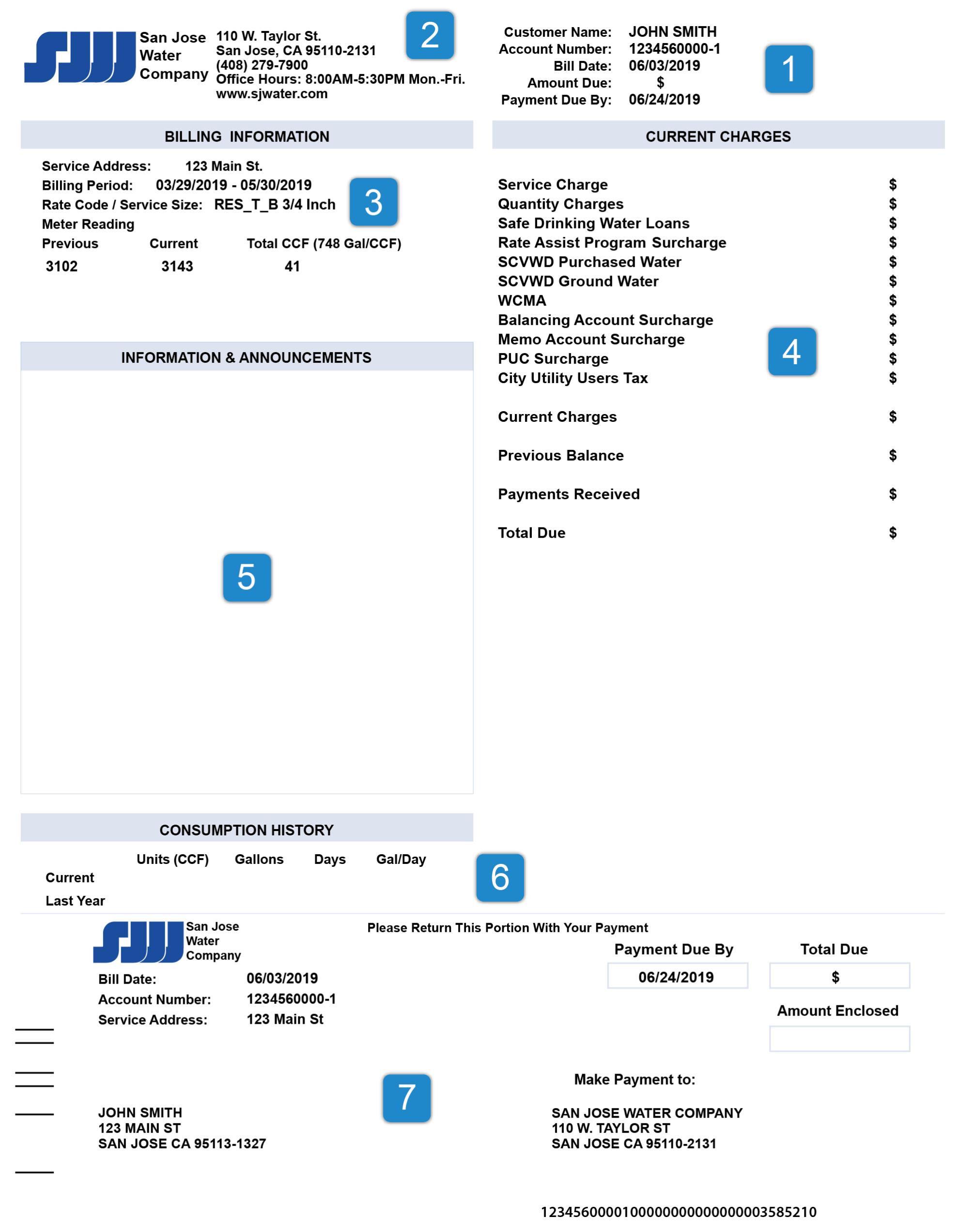

How To Read Your Bill San Jose Water

Publication 587 2021 Business Use Of Your Home Internal Revenue Service

:max_bytes(150000):strip_icc()/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)

Irs Form 2441 What It Is Who Can File And How To Fill It Out

Offline Excel Utility Procedure For St3 Return Procedure And Due Da

Service Tax And Excise Return E Filing Offline Utilities Are Now Available On The Aces Website A2z Taxcorp Llp

Incometax Software Etds Software Electrocom

:max_bytes(150000):strip_icc()/tax-documents-to-the-irs-3973948-0d372f2897a34944abb220e99cca25ce.jpg)